Setting up a charity is a rewarding but complex endeavour that requires careful planning and dedication. Whether you’re driven by a desire to address a specific social need or to honour a loved one’s legacy, navigating the process can be daunting. To shed light on this journey, we’ve compiled some guidance with insights from our Charity Insurance Client, POP Essex on how to start a charity.

Who are POP?

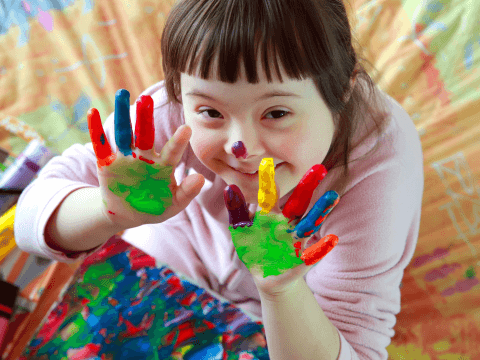

POP (Power of Play) was founded in July 2022 by a group of parents, concerned about the unexpected closure of a much-appreciated local charity, PARC (Essex) that provided play and recreation facilities for children with special educational needs and disabilities (SEND) in North Essex and surrounding areas. Parents wanted to quickly replicate that safe, secure and non-judgemental environment where their children could play, socialise and above all, be themselves. Noel Mead, a company secretary and a parent with a son with special needs, played a role in facilitating the establishment of POP along with the initial founders Matt and Jamey Carr and shared his perspectives of this process.

Reflecting on its journey of setting up a charity, POP emphasises the importance of patience and strategic planning in navigating the complexities of establishing a charity and maintaining a clear focus on objectives while remaining adaptable to evolving circumstances.

Can anyone set up a charity?

Almost anyone over the age of 16 can work towards setting up a charity (18 in limited circumstances) – you do not even need to be a UK resident. Before embarking on that journey, it’s essential to define your objectives, mission and purpose, clearly identify the social need or issue you aim to address and articulate how your charity will make a meaningful impact. For an organisation to be a charity, each of its purposes must be for the public benefit such as advancing education, relieving poverty, and promoting community or animal welfare.

Research and assess existing charities

Is a new charity the only way you can achieve your goal? Take the time to research existing charities operating in your area of interest. Assess whether there are already organisations addressing the same social need and consider opportunities for collaboration or partnership.

Collaborating with or operating through an established charity can offer various benefits, such as reducing administrative, staffing and other overhead costs. According to the Charity Commission, there are over 180,000 registered charities in England and Wales, so chances are high that you’ll find one to collaborate with. Setting up a new charity is a demanding endeavour; hence thorough research is recommended beforehand.

Matt and Jamey and other parents of SEND children recognised the importance of filling a void left by the closure of PARC and used this as the driving force behind setting up POP as a charity.

Should you set up a charity or another kind of organisation?

There are many not-for-profit organisations and social enterprises; not all of these are charities. Confirm that your chosen organisational structure qualifies as a charity, consider alternatives like a Community Interest Company (CIC), also known as a social enterprise. It’s also worth being clear on the differences between a charity and a social enterprise.

You will need to determine the appropriate legal structure for your charity or social enterprise. The legal structure of an organisation refers to its formal framework as recognised by law and defines how it is operated and governed.

A relatively new legal framework for a charity is a Charitable Incorporated Organisation (CIO). The Charity Commission handles the setting up of all new CIOs and administer all charities in England and Wales – Scotland and Northern Ireland have similar arrangements.

Many new charities register at Companies House as not-for-profit companies, limited by guarantee; a large proportion of established charities are registered in this way. For POP, parents chose this route as they wanted to have a proper framework to work within, as quickly as possible. POP was incorporated a week after parents organised a public meeting. That enabled POP to start providing services to the SEND community just 6 weeks later.

If speed is not critical, then a CIO has the advantage of charitable status from the time of approval – but allow 3 – 6 months for completion of that process.

Initial challenges and navigating legal and administrative requirements

When setting up POP Essex, Noel and the trustees encountered several significant challenges which are, unfortunately, common for emerging charities.

There was also an urgency to commence operations during school holidays – always a difficult time for parents of SEND children – which led to the decision to register as a company, although ideally preferring the structure of a Charitable Incorporated Organisation (CIO). Noel explained that POP would have liked to have registered as a CIO but needed to speed up the process, so incorporating a company limited by guarantee via Companies House, was the obvious choice.

After PARC had closed down, POP made offers to rent the building, initially to the PARC trustees and subsequently to the district council, which owned the land, but POP found it difficult to progress with either and the premises have remained empty and unused for 2 years.

How long does it take to set up a charity in the UK?

The length of time it takes to set up a charity is dependent on several factors. You will need to navigate the legal and administrative requirements associated with setting up a charity. According to Charity Excellence, it can take anything between a day, a few weeks or in some cases many months, particularly if your organisation is complex, or if it includes issues the Charity Commission tends to focus on.

Noel shared that registering as a CIO (Charitable Incorporated Organisation) with the Charity Commission takes about 3 – 6 months and is a less certain process: “If you have time, setting up a CIO with the Charity Commission would suit most new charities. The Charities Commission will answer questions and provide guidance, in their own time. It can be a slow process, but persevere!”

Noel says there seems to be more obstacles for charities to set up a bank account which can take a bit longer than a standard account as they require a recognisable legal entity to register.

As a company limited by guarantee, POP had subsequently to apply to the Charity Commission for charitable status. That was successfully attained in January 2023, which was quite quick. This facilitated tax exemptions and enhances credibility with potential donors.

How much does it cost to set up a charity in the UK?

The costs are quite low to set up a charity in the UK, but the Charity Commission requires a minimum of £5,000 funding for the new charity and a bank account. However, the banks need you to be registered as a charity first, which can be quite difficult if you are still trying to obtain charitable status in the first place. A limited company would normally expect to be able to open an account, a ‘clean bank account’. Noel confirms that when POP faced difficulties, the trustees set up a new, separate account in the name of a trustee to get around this.

Building a team

Setting up a successful charity also requires you to assemble a dedicated team of individuals who share your passion and commitment to your charity’s mission. Identify key personnel, trustees, and volunteers who bring diverse skills and expertise to the table. If at all possible, including an accountant and someone with experience of employment law and practice, would be very helpful.

POP Essex relied on the dedication of its founders and recruited individuals with first-hand experience in supporting SEND children and families. Matt Carr and his wife, Jamey, were instrumental in initiating the parent’s meeting which 60 people attended. This played a pivotal role in gathering support, through demonstrating parent power. Recruiting key personnel and volunteers wasn’t without its challenges, yet the involvement of some individuals with PARC facilitated the process.

Noel expressed that he found having the minimum number of trustees initially meant that it was quicker and easier to get documents signed off.

He also said that they adopted a flexible staffing model, including zero-hour contracts for staff, ensuring operational efficiency while keeping the fixed costs of running the charity more manageable.

Resource Acquisition and funding for setting up a new charity

Initial funding for POP Essex was primarily sourced from the key founders, supplemented by the utilisation of low cost premises (initially) and tailored activities developed by Jamey Carr with some input from Siobhan Riordan, both of whom had been volunteers at other SEND children’s charities. Because of this, not much initial funding was required. They also ensured the families and carers using the services had to pay upfront, avoiding the need for credit control and the danger of bad debts.

POP used strategic partnerships with community organisations, such as Braintree District Mencap CIO, to facilitate access to essential resources and infrastructure. Noel says, “Parents looking for the service were stunned that PARC wasn’t going to be there anymore. POP has now moved into the former Argos showroom and warehouse on a short-term lease, (now Sainsbury’s owned) which is in the centre of Braintree. This has been arranged through Community Spaces and POP, like any charity, will get 80% rates relief, hopefully up to 100%.”

Community Spaces sources commercial property for charities, community organisations and start-up businesses. Whether you are seeking premises or have a property you wish to have occupied, they will be your main point of contact and will support you for as long as is needed.

Establishing Networks and Partnerships

Establishing partnerships with local authorities and community organisations, such as Essex County Council’s Essex ActivAte, facilitated access to funding and logistical support. Essex ActivAte is the name for the government/council-funded holiday programmes run by Active Essex. Noel recommends charities contact other organisations to find similar support networks in their local area.

Grants to help set-up a charity

Grant applications for charities are formal requests made by charitable organisations to secure financial support from foundations, government agencies, corporations, or other funding bodies. These applications typically outline the organisation’s mission, goals, programmes, and budgetary needs, and they make a case for why the funding is necessary and how it will be used to further the charity’s objectives.

There are resources out there to help you with grant writing, Noel and two others went on a course run by the county council for guidance and help when applying for grants, to make their applications stand out.

Later this year, Benefact Group will be awarding grants of £10,000 and more which runs from 8th July to 2nd August 2024. If you’re a charity or know a charity that may be interested in applying for a larger grant, please register your interest here and they will keep you up to date on this initiative.

WRS Insurance Brokers is proudly part of the Benefact Group, a charity-owned, international family of financial services companies that gives all available profits to charity and good causes. You can click here for support in writing successful grant applications and building a strong case for support from Benefact Group. For further information on successful fundraising, you can also use the WRS fundraising hub.

Insurance

It’s so important to ensure adequate Charity Insurance cover is in place to protect your charity and its assets. Seek guidance from experts to understand your insurance needs and tailor cover accordingly.

WRS Insurance Brokers, who are experts in the charitable sector and now offer instant online Charity Insurance quotes, secured comprehensive cover tailored to POP Essex’s specific needs.

Noel says, “I wanted to use a broker who was aware of SEND requirements as well as being competitive. WRS already insured PARC and I was happy to work with WRS’ Account Executive, Aisha Lovegrove who I find very helpful.”

POP is insured for: Public & Products Liability, Employers Liability, Trustees & Directors Indemnity, Legal Expenses and Contents Insurance. For further guidance visit our Charity Insurance guide.

What are the advantages and disadvantages of being a

registered charity?

Advantages of charities include tax treatment, public trust, and serving a defined purpose for public benefit. However, they also face restrictions such as registration requirements, adherence to charity law, limitations on purposes, independence mandates, volunteer trustee leadership, restrictions on benefitting connected individuals, limitations on political activities, trading regulations, and transparency obligations. Your charity’s ‘purpose’ is what it is set up to achieve. For an organisation to be a charity, each of its purposes must be for the public benefit.

Lessons learned

Reflecting on the journey, Noel emphasises the importance of patience and strategic planning in navigating the complexities of establishing a charity and advises charities to: “Have a clear focus on the new charity’s objectives but make them wide enough so as not to limit actions unduly. Have a plan for achieving and delivering on those objectives, encompassing financing and fundraising, staffing and necessary qualifications; how to deliver services and how to reach relevant beneficiaries of the charity’s services.”

Aspiring charity founders are encouraged to learn from POP Essex’s experiences, leveraging insights and best practices to help navigate their journey towards impactful and sustainable charitable endeavours.

Set up a charity step by step

If setting up a new charity is the right thing for you, according to the Government website, here are 6 steps to take to set up your charitable organisation:

1. Find trustees for your charity – you usually need at least 3

2. Make sure the charity has ‘charitable purposes for the public benefit’

3. Choose a name for your charity

4. Choose a structure for your charity

5. Create a ‘governing document’ Companies House and the Charity Commission provide helpful guidance

6. Register as a charity if your annual income is over £5,000 or if you set up a charitable incorporated organisation (CIO).

About WRS

At WRS Insurance Brokers, we are specialists in Charity Insurance and Social Enterprise Insurance and our experienced team is passionate about the charitable sector. As a business with a strong social conscience, we’re passionate about helping support the work of organisations that make a difference.

Our specialists have helped many charities and not-for-profit organisations achieve the peace of mind and the insurance protection they need so that they can focus their efforts on achieving their social ambitions. Get in touch with our impartial team to discuss your needs and request a quote.

For more information call the team on 01206 760780 or email hello@wrsinsurance.co.uk.